interest tax shield explained

It is also notable that the interest tax shield value is. Such allowable deductions include mortgage.

Tax Shield Definition Formula Example Calculation Youtube

By charting the decrease.

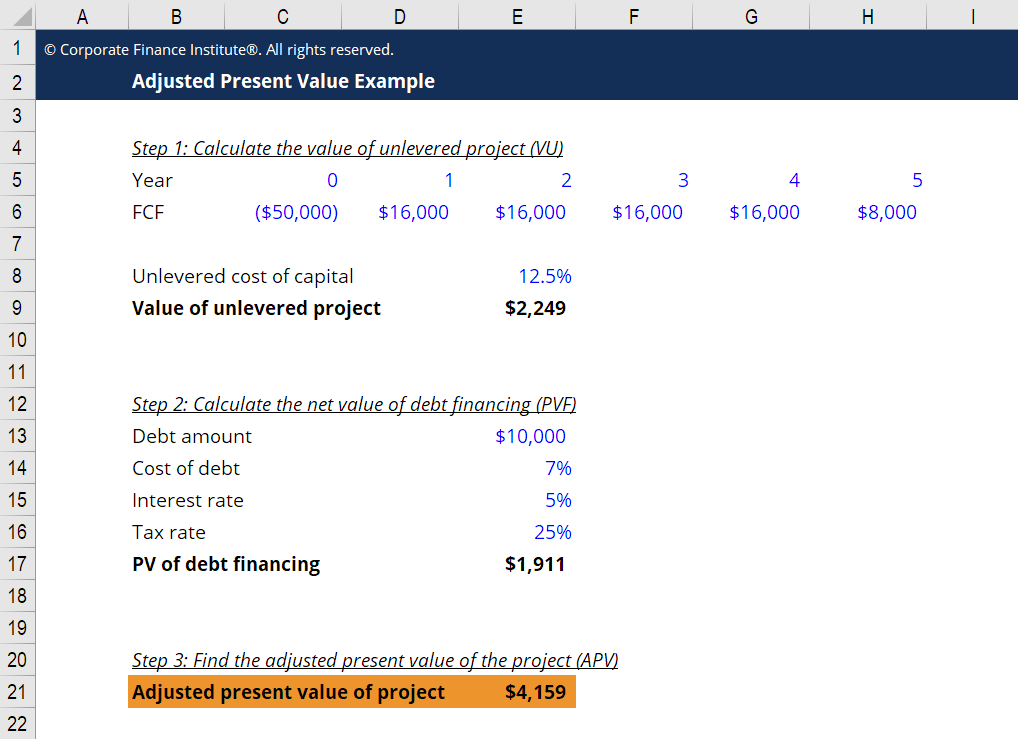

. The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest payment. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

The value of a tax. The tax savings for the company is the amount of interest multiplied by the tax rate. Companies pay taxes on the income they generate.

However issuing long-term debt accelerates interest. An interest tax shield refers to the tax savings made by a company as a direct result of its debt interest payments. The interest tax shield helps offset the loss caused by the interest expense associated with debt which is why companies pay close attention to it when taking on more debt.

How does depreciation reduce taxable income. For example Company ABC has a 10 loan of 200000. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government.

This companys tax savings is equivalent to the interest. The depreciation tax shield is a phrase used to refer to a technique by which you can reduce your tax liability by deducting depreciation from your taxable income. Interest expenses via loans.

Interest payments on loans are deductible meaning that they reduce the taxable income. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. Examples of tax shields include deductions for charitable contributions mortgage deductions.

Interest tax shields refer to the reduction in the tax liability due to the interest expenses. A tax shield refers to deductions taxpayers can take to lower their taxable income. For example a mortgage provides an interest tax shield for a.

Interest Tax Shield As the name suggests and discussed earlier the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses. If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity. In this video on Tax Shield we are going to learn what is tax shield.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. This interest payment therefore acts as a shield to the tax obligation. This can lower the effective tax rate.

CF CI CO CI CO D t. We also call this Interest tax shield. For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield.

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation. The value of a. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. As is hopefully clear by this stage the interest tax shield is. A tax shield is the deliberate use of taxable expenses to offset taxable incomeThe intent of a tax shield is to defer or eliminate a tax liability.

Interest Tax Shield Formula Average debt Cost of debt Tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses. Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

Depreciation Tax Shield Formula And Excel Calculator

The Interest Tax Shield Explained On One Page Marco Houweling

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

What Is A Tax Shield Depreciation Tax Shield Youtube